This coverage extends to office supplies, computer equipment, and even the software you might need to perform your daily responsibilities. If used for essential business purposes, your tools and supplies count as business expenses. Here are some of the most common examples of expenses that you might incur as part of your job: Tools and supplies To be clear, an "ordinary expense" is anything that is common and accepted in your trade or industry.

UNREIMBURSED BUSINESS EXPENSES HOW TO

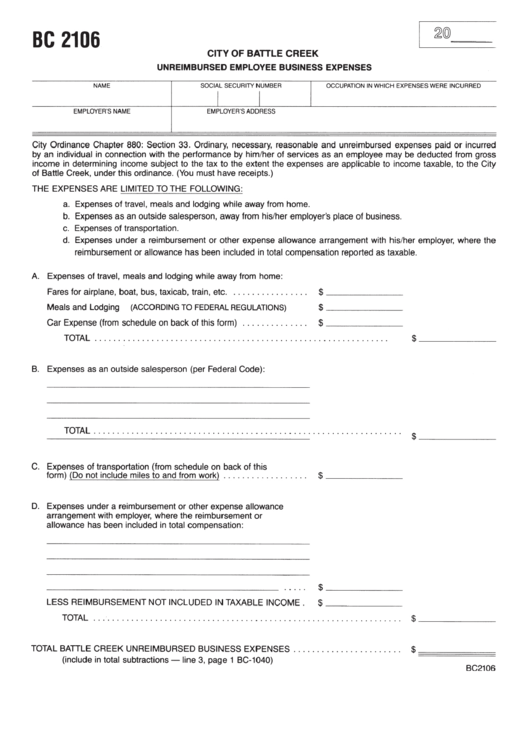

Here’s what you need to know about unreimbursed business expenses, including who can deduct these expenses from tax returns and how to do it: What are unreimbursed business expenses? Unfortunately, most employees can’t deduct unreimbursed employee expenses on their income tax return, which means that if they aren’t reimbursed by their employer, they’re out of luck.

But when employers fail to pay their employees back for these expenses, it’s known as an unreimbursed business expense. You may also deduct any work clothes or uniforms that are not suitable for everyday use and are a condition of your employment.Typically, business owners reimburse their employees when they incur a necessary expense in the workplace. You may deduct any legal fees related to doing or keeping your job. It is also permissible to deduct any job search expenses incurred while searching for a job in your current occupation. You are permitted to expense home office costs, as long as the home office is your principal place of business. You are also permitted to deduct the cost of laundry, meals, baggage, telephone expenses, and tips. If you are away from home on an assignment that lasts less than a year, you will be able to expense the costs for a taxi, plane, train or car. If you have not been reimbursed by your company, you are able to expense any work-related travel expenses. Tolls and gas are not deductible for regular transportation to work.

Parking at your permanent place of work is not deductible. You cannot deduct the cost of traveling to and from work, no matter how it is done. You cannot deduct typical commuting costs within your metropolitan area. However, there are travel expenses that are not deductible. Parking, tolls, and gas are deductible for work-related trips. If you have no permanent office and work regularly within your metropolitan area, you can deduct the cost of travel outside that metropolitan area. Auto costs that can be deducted include expenses for traveling between one workplace and another, visiting clients, getting a temporary workplace, and going to a business meeting away from your regular workplace. Most importantly, the costs cannot be reimbursed by your employer.Īuto and travel expenses are among the most common work-related deductions. In order for your deductions to qualify, all expenses must be incurred during the tax year, must be trade or business related, and must be “ordinary and necessary.” However, the expenses are allowed to be taken even if they are not required. You can deduct only the expenses over that amount. You are also required to meet the “2% floor.” This means that the total of the expenses you deduct must be greater than 2% of your adjusted gross income. In order to deduct workplace expenses, your total itemized deductions must exceed the standard deduction. If you’re a salaried employee, your deductions can include job-related expenses. Finding every available deduction will allow you to maximize your return. As an employee, you may be able to deduct unreimbursed business expenses on your upcoming 2017 tax returns.

0 kommentar(er)

0 kommentar(er)