Capital Expenditures (Capex)įor example, the impact of periodic acquisitions should be removed, due to being one-time, unforeseeable events. Learn More → Enterprise Value Quick Primer Periodic Acquisitions vs. The projected FCFs must strictly come from the company’s recurring operations otherwise, the implied valuation loses credibility.

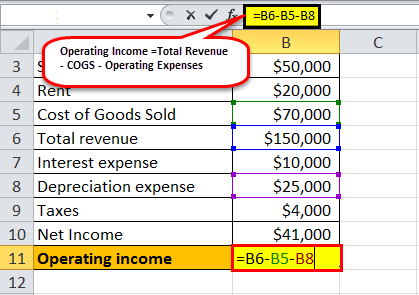

FORMULA OPERATING INCOME FREE

In the case of intrinsic valuation – most often via the discounted cash flow (DCF) model – the free cash flow (FCF) calculation should include just the inflows / (outflows) of cash from the recurring operations of the company.Īs a result, a company’s financials must be adjusted to exclude non-operating income, which stems from non-operating assets, and is a crucial step to accurately forecasting a company’s future performance. When estimating the value of an asset such as a company, the valuation should isolate and reflect only the company’s operating, core assets. Enroll Today Valuation of Operating Assets Intrinsic Valuation (DCF) Level up your career with the world's most recognized private equity investing program. Hence, line items such as interest income and dividends are separately broken out on the income statement within the non-operating income / (expenses) section.Īnd Wall Street Prep Private Equity Certificate Program The monetary benefit provided by these assets comes in the form of interest income, yet a company could hypothetically continue conducting business as usual even if these securities were to be liquidated. Marketable securities and related cash equivalents are examples of non-operating assets, regardless of the income generated by these types of low-risk investments.įinancing assets are indeed assets with positive economic value but are classified as non-core assets. Unlike operating assets, non-operating assets are not considered a core aspect of operations.Įven if the asset produces income for the company, the stream is considered “side income”. Operating Assets, net = Total Assets – Non-Operating Assets.The value of a company’s operating assets is equal to the sum of all assets minus the value of all non-operating assets. If an asset is required for day-to-day operations to sustain itself, it is most likely an operating asset since its contribution is essential.Ĭommon examples of operating assets include the following: Operating assets have an integral role in the core business model of a company. Operating Assets are necessary to a company’s ongoing core operations and directly support the continued generation of revenue and profits.

0 kommentar(er)

0 kommentar(er)